There Are Many Ways You Can Make a Donation

Fisher House So Cal was established to build a Fisher House in Long Beach and the success of that development resulted in the organization being invited to expand its support to all of southern California, including Camp Pendleton and San Diego. Fisher House So Cal has expanded its mission to include four Fisher Houses and temporary lodging support for veterans and military families when no Fisher House is available in southern California.

Your generous, tax-deductible donation to Fisher House Southern California Inc. (FHSC) will change the lives of active and retired military servicewomen and men and family members. You will help bring comfort to military and veteran families, providing them with lodging at no cost to them while their loved ones undergo medical treatment.

One Time Donation

You can make a donation of any amount by check directly to our post office box. Our online donation platform accepts one-time donations starting at $25.00.

Your Donations are Tax Deductible

Fisher House Southern California is a duly registered 501(c)3 with the Internal Revenue Service and with the state of California and complies with the fundraising rules of the California Attorney General. Donations to Fisher House Southern California qualify as a charitable deduction for federal income tax purposes. Please consult with your tax adviser or the IRS to determine whether a contribution is deductible. Tax ID # 46-1815286. Donations made directly to any Fisher House may not qualify for tax deduction.

Recurring Donations

We’re grateful for the many donors who establish recurring monthly giving. Simply click on the “recurring” box on our donations page to set this up and regularly manage your account by logging in.

Planned Gifts

There are many ways to establish planned gifts to Fisher House Southern California, providing you with opportunities for your estate and legacy planning through benefit and gift strategies such as Charitable Gift Annuities and Charitable Remainder Trusts that provide you with regular income and tax savings.

For more information, please contact:

Federal Employee Payroll Deduction

Are you a federal employee?

Contact your payroll administrator for details.

All federal employees can support FHSC through CFC payroll donations. To set this up, remember to enter CFC# 80787 to support Fisher House Southern California.

Employer Matching Gifts

Talk to your employer and nominate Fisher House Southern California for your employer’s giving or matching gifts.

If your employer doesn’t have a matching program, contact:

We’ll gladly help you set one up.

Prefer to Send Us a Check?

Make checks payable to:

Fisher House Southern California, Inc.

And mail to:

Fisher House So Cal

P.O. Box 110 Long Beach, CA 90801

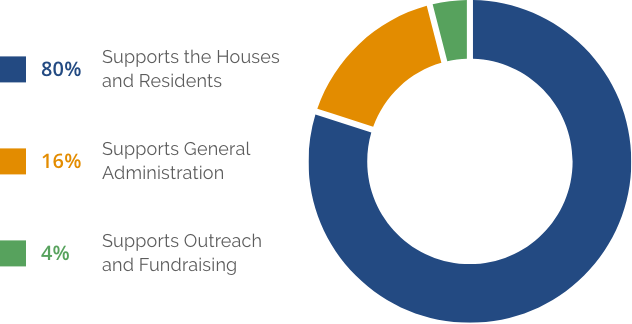

How Your Donations are Used

Unless otherwise specified, your donation will be used to support all three of the locations we support including the Fisher House-VA Long Beach, Fisher House-Naval Hospital Camp Pendleton, and Fisher House-Naval Medical Center San Diego.

If you would like your donation to specifically support one of these houses, please indicate “Designation: [location name]” in the memo section of your check or when making your gift online. Please provide your return address with your donation, as we will mail you a donation receipt for your records.